Clear money movement builds trust. People plan evenings around when funds appear, not around slogans. Payment transparency is simply this – honest clocks, plain labels, and receipts that reconcile across the app and the bank. When timing rules are visible and consistent, decisions feel calm, and support threads stay short.

What timing really means in practice

Most mobile cashiers follow the same few patterns – settlement clocks, authorizations, and posting windows – read more, then return to the cashier with realistic timing in mind. The idea is to turn vague “soon” into a sequence the phone can show and the user can verify. A good flow stamps each step with a state and a time – the moment a deposit authorizes, the minute a withdrawal leaves the queue, and the window when funds typically post on card or bank rails. With the sequence visible, the rest of the experience becomes predictable.

Hold periods, decoded

A hold is not a charge. It is an authorization – the bank sets money aside while the processor confirms details, and the merchant later captures the amount. Holds appear immediately on card statements even though the settlement comes later. If a request is canceled or expires, the hold is removed, typically within one to three business days, depending on the issuer. Bank transfers behave differently. They move in batches and respect business-day cutoffs, so a Friday-night cash-out often reaches the ledger on Monday. Wallets sit in between – balances update quickly inside the wallet, while withdrawals from the wallet to the bank still follow banking hours.

The cleanest cashier explains those differences before the button is pressed. “Card – available to spend now, settles later.” “Bank – posts on business days.” “Wallet – instant inside wallet; bank cash-out next business day.” Plain phrases remove guesswork.

Instant methods – how “instant” really works

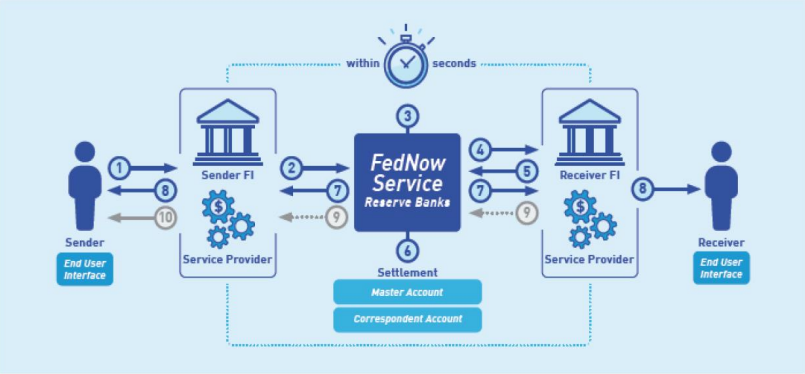

“Instant” describes the user’s screen, not the entire network. Wallet-to-app deposits are fast because both sides maintain always-on connections, allowing for later reconciliation. Card rails often show an immediately available balance because authorization succeeded, even though the capture may take hours. Real-time payments exist in some regions, but limits and bank participation vary. For withdrawals branded as instant, providers pre-approve common amounts on familiar routes and then settle behind the scenes. That is why first-time payouts or large jumps in value may slow down – the system needs to re-establish trust.

A responsible interface tempers the word “instant” with context. It pairs the label with a clock – “usually under 10 minutes” – and shows a fallback – “if delayed, expect by morning.” This blend preserves confidence even when the rail has a rare wobble.

What speeds or stretches the clock

- Route fit – cards, wallets, and banks each have distinct posting windows; mismatching the route to the moment adds hours.

- Identity confidence – names, addresses, and devices that match past behavior pass automated checks; fresh profiles invite manual review.

- Amount pattern – big jumps in deposit or withdrawal size trigger extra verification; predictable chunks clear faster.

- Weekends and cutoffs – banking systems batch during business hours; late-night Friday requests often queue.

- Device stability – switching phones mid-request creates duplicate attempts and anti-fraud flags.

- Method changes – adding a new card or bank right before a payout nearly always slows the first transfer.

Understanding these levers lets users choose methods that fit the calendar rather than fight it.

Designing a clean cash-out routine

A tidy routine beats hunches. Start requests during local banking hours, ideally mid-morning or early afternoon. Maintain one primary payout route for a full month to keep the profile looking steady. When changing methods, run a tiny proof first – a small deposit and a small withdrawal on a weekday – before moving larger amounts. Use predictable chunks rather than a single oversized figure; sometimes three modest payouts pass faster than one that trips manual oversight. After sending a request, save the confirmation with the reference ID and expected window. If a delay occurs, support can nudge the processor with those details immediately.

Interface discipline helps. Launch the cashier from the same device and the same entry each time. Turn on two-factor authentication through an authenticator app so trust checks do not hinge on SMS. Keep notifications for deposits, withdrawals, and limit changes, while muting promotional pings. When the signal is clean, timing feels honest.

Signals that a platform is transparent

A trustworthy cashier is legible at a glance. States read the same in the ledger, the receipt, and the email. Timestamps include time zones and show when business-day rules apply. “You send / You receive” totals update live as the method changes, with currency conversions and fees shown before committing. Reference IDs appear in three places – on-screen, in notifications, and in exports – so questions never become scavenger hunts. Maintenance windows are announced in local hours, and incident notes explain what happened and what was unaffected. Most importantly, settlement sources and posting windows are explained in everyday language so expectations match reality.

A tidy wrap – clocks, not slogans

Payment transparency is clocks and receipts, not promises. Holds mark intent; settlements move on the rail’s schedule; “instant” is real on the screen even when back-end posting follows. Users who align the method with the moment – card for quick availability, bank for larger weekday moves, wallet for frequent small sessions – meet fewer surprises. Platforms that publish states, times, and references earn repeat use because the experience is predictable. With timing made visible, evenings end on schedule and trust compounds round after round.